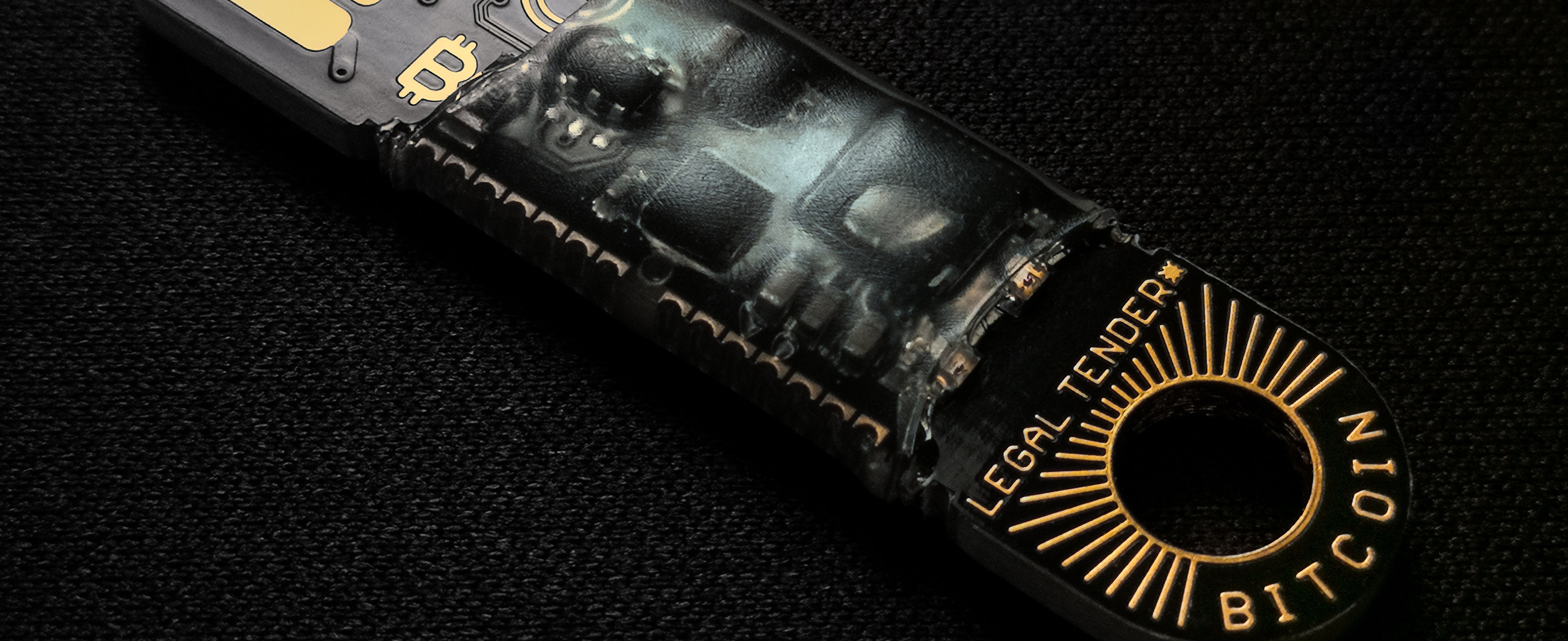

Cryptocurrencies have been in and out of the spotlight for the past few years with Bitcoin marking its 12th birthday recently. While Bitcoin (and blockchain technology) has been in existence since 2009, true institutional adoption has only started to accelerate in pace since mid-2020. On Wednesday, 9th June 2021, we witnessed an historical event taking place as El Salvador passed a bill to officially adopt Bitcoin as legal tender. As the first ever sovereign nation to adopt a cryptocurrency as legal tender, El Salvador hopes that Bitcoin will increase financial inclusion for its citizens, 70% of whom do not currently have access to financial services.

Whilst El Salvador’s decision is a significant boost for the legitimacy of Bitcoin and blockchain technology more broadly, it also has far reaching implications for economies, governments, and organisations everywhere. What does the adoption of cryptocurrency by a sovereign nation actually mean for the global economy? How will this affect the overall adoption of Blockchain Technology in the coming years?

The Blurred Definition of “Money”

Bitcoin and cryptocurrencies in general are typically classified as digital assets and therefore, subject to asset-like treatment in most jurisdictions around the world. As countries begin passing legislation to grant cryptocurrency status as legal tender, it also places them on the same level as fiat currencies such as the US Dollar. In El Salvador, the current bill recognises the ‘sat’ (Satoshi – smallest unit of a part of Bitcoin), creating the potential for Bitcoin to see widespread adoption – sparking a whole new level of adoption and complexity. But can one ever transact freely and without complexity if the default process is to peg everything against fiat markets – including Bitcoin and cryptocurrencies? Or will the true level of adoption will be established when Bitcoin (or another cryptocurrency) becomes the central unit of account upon which everything else is valued?

The true legal, economic, geopolitical, and social implications of El Salvador’s decision will remain to be seen in the coming months and years. However, for now, there is presently no formal legal authority in the United States on how cryptocurrencies will be treated for U.C.C. (Uniform Commercial Code) purposes. The same challenge is being echoed throughout Europe and other countries around the world. The inherent scarcity of Bitcoin means that price volatility will always be a factor in play, which begs the question – how does one reliably transact on such a volatile unit of account?

The Future of Technology, Non-Linear Change and The Network Effect

From its early origins as a ‘peer-to-peer electronic cash system’, blockchain has enabled a proliferation of rich ecosystems and technologies that are gaining more real-world use-cases. As technology and cryptocurrencies mature, and increasingly smarter and more complex systems (powered by blockchain, artificial intelligence and algorithms) consume greater amounts of information and data, leaders are already augmenting their strategy and decision making with digital technology. The increasing reliance on technology to predict, identify, automate and evaluate work is something that sets the digital era apart from earlier periods of innovation and industrialisation.

Once business and government-level adoption increases globally and Bitcoin gains further mainstream spotlight, significant collateral exposure will occur. No one wants to be first, and no one wants to be last. Organisations and Institutions oblivious to cryptocurrencies and Blockchain Technology previously will start their due-diligence processes in fear of being made irrelevant. But, whilst blockchain and artificial intelligence systems may potentially free leaders from the chains of menial and low-value-added tasks, their inherent complexity and influence may also have impact in unforeseen and unintended ways. The complexity of modern networks and digital ecosystems represents a diverse array of connected elements and linkages. As the complexity of a system increases so to do the number of possible outcomes.

In terms of adoption, The Network effect is one of, if not the single most important factor. As defined by Metcalfe’s law, the value of a network is proportional to the square of the number of connected users of the system. In short, network effect is the most powerful driver to more adoption, and often the pace of growth will be exponential. In a hyper-connected world, complex ecosystems and interactions exhibit non-linear change; the real-world manifestation being the potential for compounding, cataclysmic crises triggered by a seemingly innocuous and disparate events. 2020 saw the realisation of a global pandemic – a perfect example of non-linear change at a speed and scale that rapidly overwhelmed many of society’s systems and safety nets. In a world where data and information can be transmitted and distributed in an instant, companies must carefully consider and plan for unintended technological events and ensure that the trust, privacy and confidence of employees and consumers is fiercely protected.

The dominos are falling, and below are some of the latest statistics to prove it.

The Smarter and More Efficient Blockchains

Advances in technology, automation, connectivity and artificial intelligence are colliding with the physical world, forcing leaders and organisations to innovate at pace to stay current in a rapidly changing economic, social and political landscape. New technologies are transforming the way leaders make decisions and with a world of information only a click away, Industry 4.0 is marking the shift from industrial capitalism to information capitalism.

Bitcoin will likely be a significant player in the Blockchain landscape, but there are an abundance of other, purpose-built Blockchains that are beginning to see more mainstream adoption. Smart contract abilities on Ethereum for example, with proper strategy and implementation, could disrupt many sectors and industries – driving decentralisation, disintermediation and potential workflow and value exchange efficiencies. As Proof of Stake (PoS) and other more efficient consensus mechanisms see increased use, it is likely that the negative environmental stigma of blockchain will begin to fall away, further removing barriers to its mainstream adoption (Ethereum also to adopt PoS in ETH 2.0). Investigation and investment in Blockchain Technology now will place businesses in a strong position to solve growing issues around the world, delivering decentralised, transparent and trustless value all whilst remaining compliant with many of the common sustainability goals.

Reimagining the Future

Blockchain is an emerging technology that is generating considerable interest and investment from government, industry, and consumers around the world. Through the combination of cryptography, peer-to-peer networks, and programs (or ‘smart contracts’), blockchain technology promises a transparent, tamper-resistant and secure solution with the potential to transform and disrupt current business models and create entirely new business eco-systems. As forces of change such as digitalisation, regulation and shifting consumer sentiment drive organisations to be more transparent and place greater focus on environmental, social, and corporate governance (ESG), there is increasing interest in the potential for blockchain technology to drive structural transformation.

The adoption of Bitcoin assets and cryptocurrencies as legal tender and assets is just the tip of the iceberg. Various forecasting models predict that:

Is your organisation ready for tomorrow?

Education and knowledge will be key to the effective assessment, selection and adoption of any technology. Ensuring that decisions are aligned with strategic directions and operational plans will see value realised across all parts of a business’s value chain. As governments pull economic and stimulus levers in an attempt to revive stalled economies, the complexities of an artificial economic environment will present many challenges on both a domestic and global scale. Digital technology must be a key pillar of any organisation or government’s strategic vision and as the pace of change accelerates, those who do not prepare for and embrace the future, will certainly become part of the past.

Strategy Hubb invites you to join with us and let us guide you through your Blockchain Technology journey and beyond.

The internet of assets awaits with Strategy Hubb, your intellectual-property partner.

Disclaimer: Please note that the information provided in this article is not to be considered as financial advice. Please seek advice for your personal or business matters from a qualified professional or make contact with myself or one of the team at Strategy Hubb to tailor custom solutions to accommodate your circumstances.